Collect Payments On Site

Accept payments as soon as the job is complete via a QR code or SumUp payment terminal.

When it’s time for customers to settle their bills, providing convenient ways to pay is the cherry on top of a great experience. That’s why Commusoft offers various billing integrations. After all, flexible payment solutions enable trades businesses to broaden customer payment options, reduce administrative workload, and ultimately get paid sooner.

Accept payments as soon as the job is complete via a QR code or SumUp payment terminal.

Enable customers to pay from anywhere via card, bank transfer, or Apple and Google Pay.

Set billing schedules and collect automatic payments for service contracts.

Set limits for credit card payments with Stripe and enable GoCardless instead.

Offer convenient ways to pay to encourage customers to settle their bills quicker.

Maintain a database of invoices and payments, and accurately track profits and debts.

Paul

Director

Switched On Electrical

Commusoft makes managing the entire process, from enquiry, to creating the invoice, and accepting payment, very easy!"

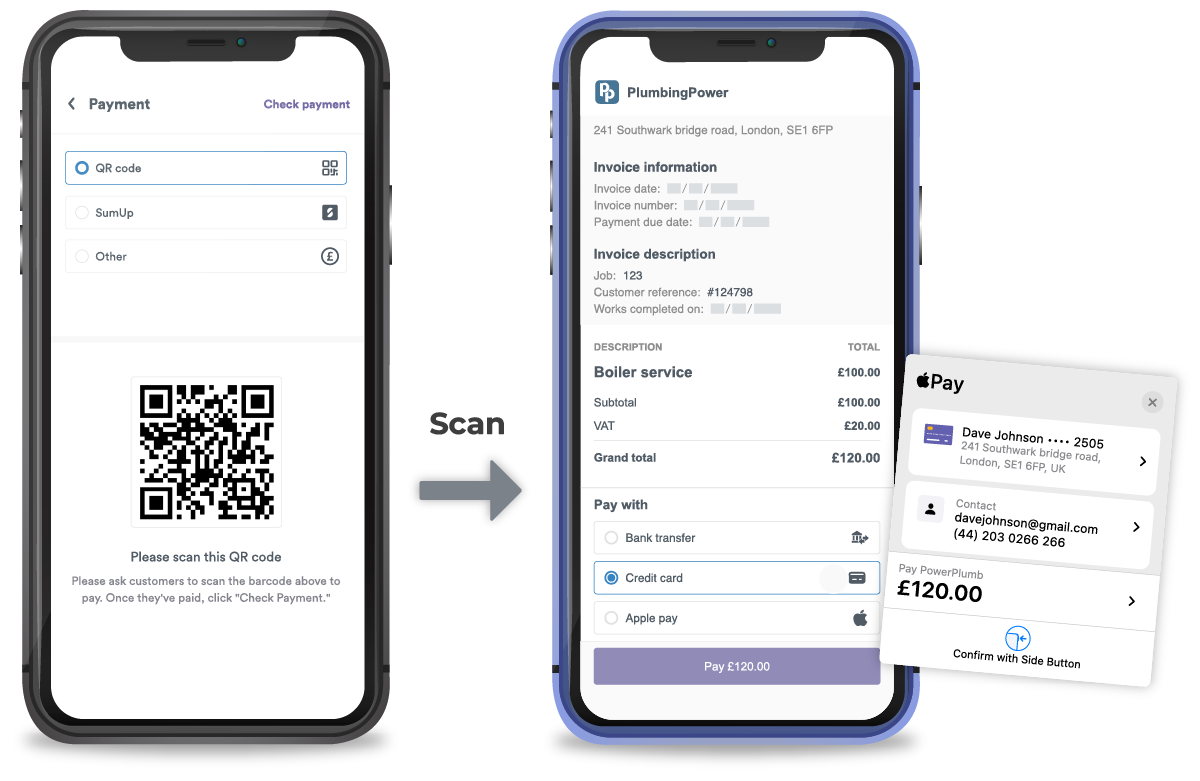

Your crew can accept payments in the field through Commusoft’s mobile app. Engineers simply use a payment terminal or instantly generate a QR code to collect card or contactless payments. Perfect for smaller jobs, your crew can quickly take the payment, receive an instant confirmation, and move on to the next appointment.

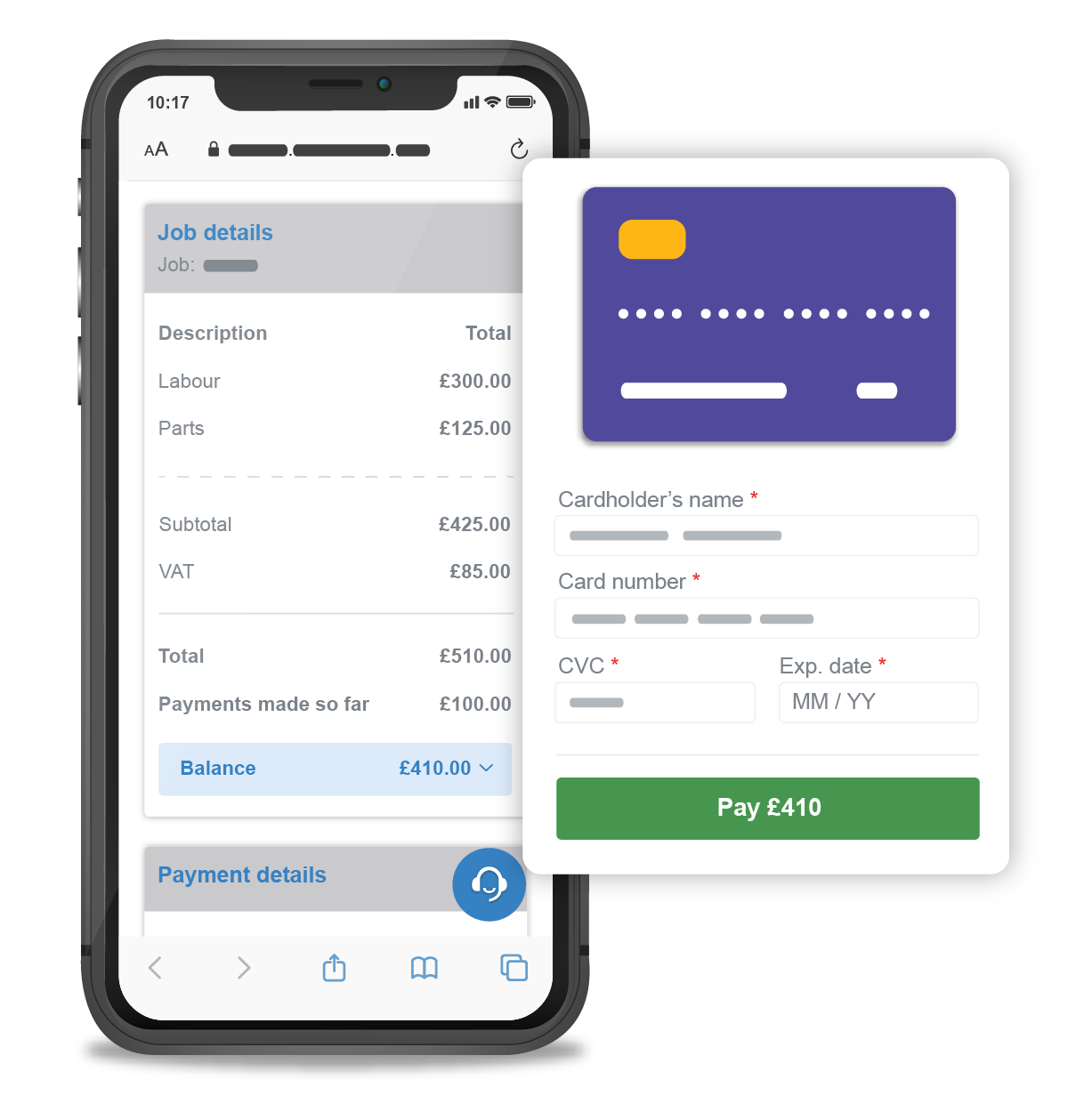

Send customers a secure payment link so they can pay when it’s most convenient for them. Here they can review their invoice, and pay via credit card, bank transfer, or Apple/Google Pay. With this process, Commusoft makes it easy for customers to pay initial deposits, partial or final invoices, as well as multi-invoice payments through a variety of specialised online portals.

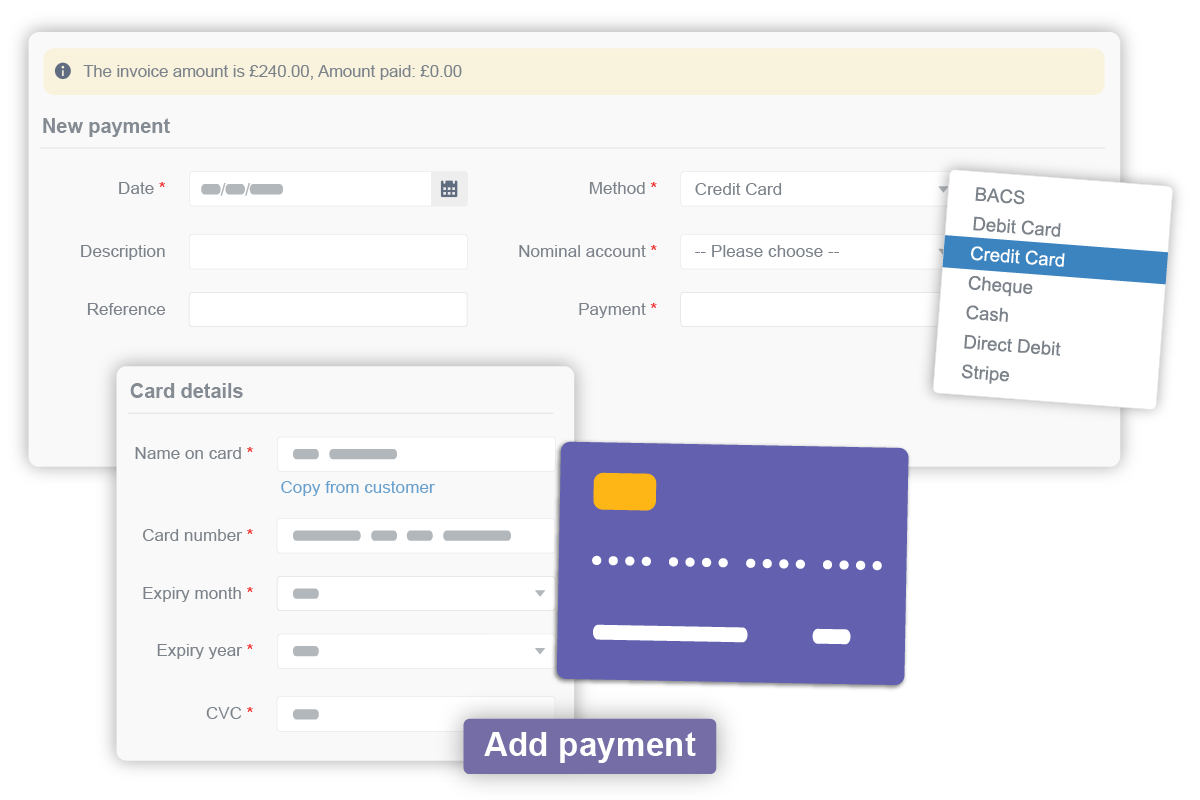

Some customers might prefer to settle their bills over the phone. When customers call in, admins can easily access the job, review the invoice in question, and charge the card then and there. Even more, your team can store card details when the job is created and push the payment through when it’s time to pay.

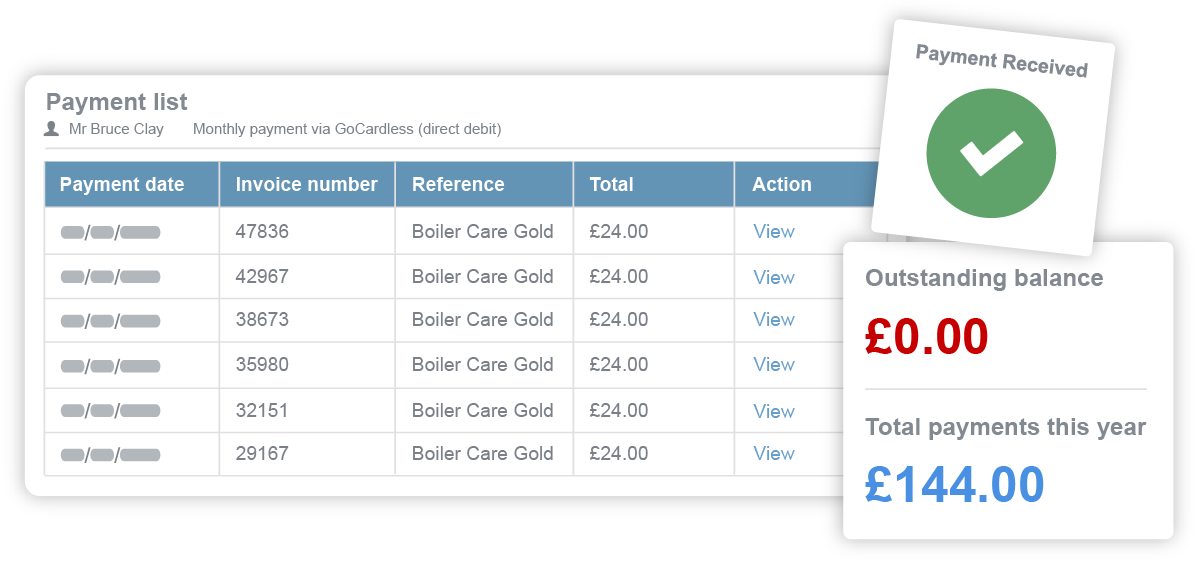

If you offer service contracts with recurring billing cycles, you can alleviate the headache of managing monthly payments and keep all the data under one roof. You simply connect GoCardless (via direct debit) to your custom service contracts in Commusoft to start collecting automated repeat payments.

With one click from their email, customers can view their invoice details and amount due. With a range of payment options, they can choose what's most convenient for them and send the funds your way easily and promptly.

Especially useful for commercial clients, a custom statement portal enables customers to review any unpaid invoices and allow them the option to settle one or multiple bills simultaneously.

Your team can set monetary limits for when certain integrations are implemented. For example, if a charge is over £1,000, GoCardless will be offered instead of Stripe; meaning you won’t have to pay large credit card fees.

By collecting optional deferred payments, you can take greater control over when you get paid. Admin staff can guarantee funds are available by placing a pre-charged block on the agreed upon funds on a customer’s card. Once the service is complete and it’s time to collect payment, your team can finalise the charge straightaway, eliminating any delay in getting paid.

When charging for a large job, you might opt to charge in multiple stages, such as a partial invoice for parts and materials. With Commusoft you can include a link to your payment portal in an email or text message, no matter the stage of the job.

As soon as the job is complete, engineers can present customers with a QR code prompting them to “scan to pay”. This will open a personalised payment page, where customers can choose between various payment options, including Apple or Google Pay. With this method, your crew can quickly collect payment on-site, without the need to carry payment terminals.

For recurring standard services, like an annual boiler service, your team can choose to request and accept payments in advance directly within the online scheduler. As soon as the customer selects their appointment date, they’ll be prompted to pay for it, before the job is scheduled.

Payment integrations are the process of connecting two software together. Great integrations ensure seamless, secure, and timely payments. Further, they improve customer satisfaction by providing convenient experiences, such as recurring auto-payments, stored card details, and the ability to review custom statement portals.

Commusoft can do this, and so much more; learn more about each of our payment integrations here.

Commusoft’s payment integrations are all accessible within the Commusoft platform, meaning users won’t need to flip back and forth, reducing administrative workload.

Furthermore, we offer diverse payment integrations, so you can extend various payment options, recurring billing, and credit card limits.

Commusoft integrations make it easier to build trust and offer all-in-one experiences for customers. You can add company branding to your integrated payment portals, so customers will be confident they’re paying the right people. Ultimately, streamlined payment journeys ensure your team will get paid faster and with less stress.

Ready to optimise your payments? Book a call with our team today!

Commusoft Sales and Jobs offer different payment capabilities.

Commusoft Sales enables users to take deposit payments upon proposal acceptance. This means you can prepare for the service, such as ordering necessary parts, straightaway.

Commusoft Jobs organises payments owed during or after the service. The Jobs platform enables users to offer various invoice types, such as partial and final. Further, users can offer automated recurring contract billing, and collect payments via diverse payment types.

These solutions empower your team to organise and collect payments with confidence, so you can easily cater to all customer needs. Learn more about Commusoft’s Sales CRM and Jobs management platform, and discover how you can get the best of both worlds!

All of our integrations are available to our clients at no additional cost. All you need are Commusoft and accounts with the specific integrations. Please note, some integrations may only be available on certain Commusoft plans.

Exact pricing depends on which Commusoft product and plan you need, the number of licenses, and the platform you’re integrating with. Learn more about Commusoft’s pricing plans here.

Discover more ways the Commusoft platform can help your team take full control of customer payments!

Learn about how you can get paid quicker. Your team can send professional digital invoices directly from the field, automatically, or let your office team handle payments.

Commusoft’s mobile app empowers engineers to accept jobs, build reports, invoice and accept payments, and more, all from the field. This means your office and remote teams will always be in-sync.

Give commercial and multi-property owner customers 24/7 access to job reports, invoices, job statuses, and more. They know which bills are outstanding and can settle them straightaway.

You can collect deposit payments from customers as soon as they accept your services. This means you can move forward with preparing for the job and make any necessary purchases.

We discuss the significance of offering and accepting digital payments, and how your trades business and customers can benefit.

We sit down with Pat Phelan, Chief Customer Officer of GoCardless, to discuss how Instant Bank Pay can transform customer payments.

Learn about why offering recurring payment plans is essential for businesses that offer contract services, and how it impacts customer retention.